accumulated earnings tax calculation example

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder-level tax seeSec. Part I Accumulated EP of Controlled Foreign Corporation.

Income Tax Computation For Corporate Taxpayers Prepared By

The majority of businesses use accumulated earning computations for tax purposes and to assess the value of tax treatment.

. Shareholders information to complete an amount in column e see instructions. Calculation of Accumulated Earnings. Calculating the Accumulated Earnings.

Let Us Do the Legwork. Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. A Post-2017 EP Not Previously Taxed post-2017 section 959c3 balance b Post-1986.

Reports are that the Biden proposals could increase the tax on dividends for the wealthy to 396 percent compared to the current 20 percent. Get a demo today. Section 1312-6 addresses how to calculate corporate EP accumulated earnings is generally the amount of profits a corporation retains after distributions to shareholders in the form of dividends are taken into account netted over the life of the corporation.

The formula for computing retained earnings RE is. For example suppose a certain company has 100000 in retained earnings at the beginning of the year. For example lets assume a certain company has 100000 in accumulated earnings at the beginning of the year.

The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC Section 535 by 20. Accumulated earnings and profits EP are net profits a company has available after paying dividends. Check the box if person filing return does not have all US.

Discover Helpful Information And Resources On Taxes From AARP. 25000 250000 Accumulated EP at Beginning of Year. IRC Section 535c1 provides that.

Plus there is the 38 percent tax that can apply to higher levels of investment income Sec. This figure is calculated as EP at. See What Credits and Deductions Apply to You.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious incentive existed for. The accumulated earnings tax is a charge levied on a companys retained earnings. Given that there has been little change other than rates in the taxation of accumulated earnings the guidelines may still be useful in planning and in dealing with examining agents.

No dividend was paid. Free Federal Filing for Everyone. The company made a net profit of 700000 and paid 300000 in dividends in the same year.

Also called the accumulated profits tax it is applied when tax authorities determine the cash on hand to be an excessively high amount. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information. This taxadded as a penalty to a companys income tax liabilityspecifically applies to the companys taxable income less the deduction for dividends paid and a standard accumulated tax credit of 250000 150000 for personal service.

Accumulated Earnings Tax can be reduced by reducing Accumulated Taxable Income. Ad Enter Your Tax Information. To determine whether a corporation has an NOL figure the dividends-received deduction without the 65 or 50 of taxable income limit.

The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. RE Initial RE net income dividends. The formula for calculating retained earnings RE is.

Under current law the tax on dividends can reach an incremental 20 percent. The company made 700000 in net profits and paid dividends worth 300000 in the same year. It has earnings and profits for the taxable year ended December 31 1975 in the amount of 115000 and has a dividends paid deduction under section 561 in the amount of 10000 so that the earnings and profits for the.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. A comprehensive Federal State International tax resource that you can trust to provide you with answers to your most important tax questions. The Worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax and a sample taxpayers statement pursuant to 534c and Regs.

The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. Accumulated Earnings Tax Calculation LoginAsk is here to help you access Accumulated Earnings Tax Calculation quickly and handle each specific case you encounter. Corporate Federal Income Tax Paid.

How Does Accumulated Earnings Tax Work. Enter amounts in functional currency. RE initial retained earning dividends on net profits.

Section 531 imposes a tax on some accumulated earnings. The Z Corporation which is not a mere holding or investment company has accumulated earnings and profits in the amount of 45000 as of December 31 1974. Ad Produce critical tax reporting requirements faster and more accurately.

Calculating the Accumulated Earnings Tax. If a corporation has a net operating loss NOL for a tax year the limit of 65 or 50 of taxable income does not apply. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high.

A corporation loses 75000 from operations. Accumulated EP on January 1. See How Much You Can Save With Our Free Tax Calculator.

To calculate the number of accumulated earnings the sum of the accumulated profits at the beginning of the year must be added to the current accumulated earnings less any dividends given to investors. Ad Contact 100s of Local Tax Accountants Free Today.

Earnings And Profits Computation Case Study

Income Tax Computation For Corporate Taxpayers Prepared By

Earnings And Profits Computation Case Study

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Effective Tax Rate Formula And Calculation Example

Demystifying Irc Section 965 Math The Cpa Journal

Accumulated Deficit Definition And Causes Of Negative Retained Earnings

Cost Of Retained Earnings Commercestudyguide

Earnings And Profits Computation Case Study

Demystifying Irc Section 965 Math The Cpa Journal

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

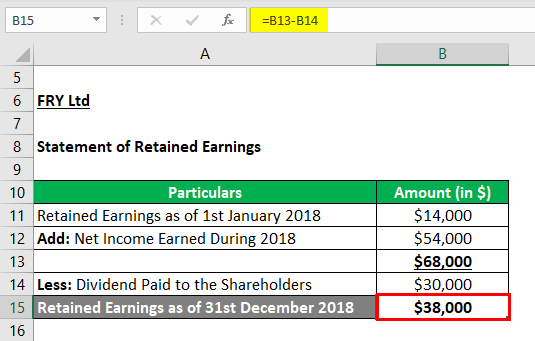

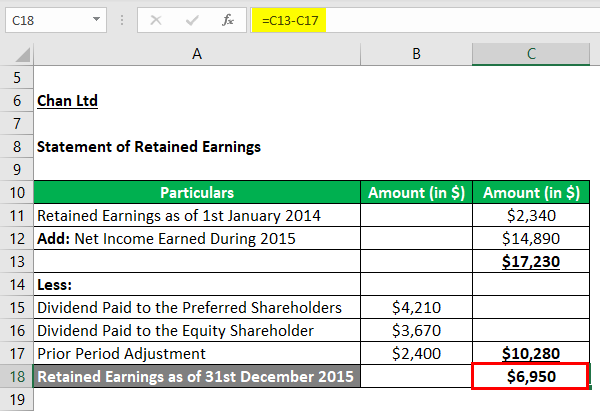

Statement Of Retained Earnings Example Excel Template With Examples

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Demystifying Irc Section 965 Math The Cpa Journal

Statement Of Retained Earnings Example Excel Template With Examples

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza